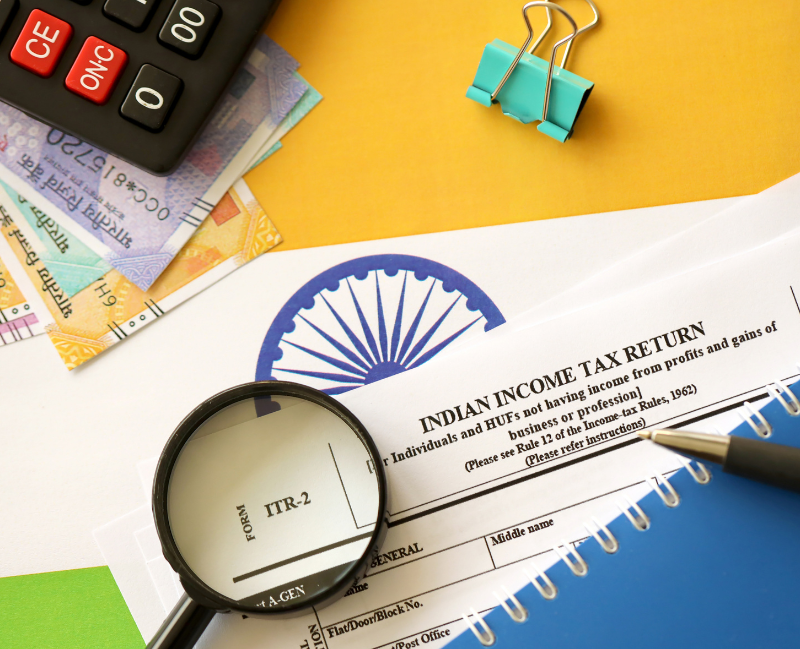

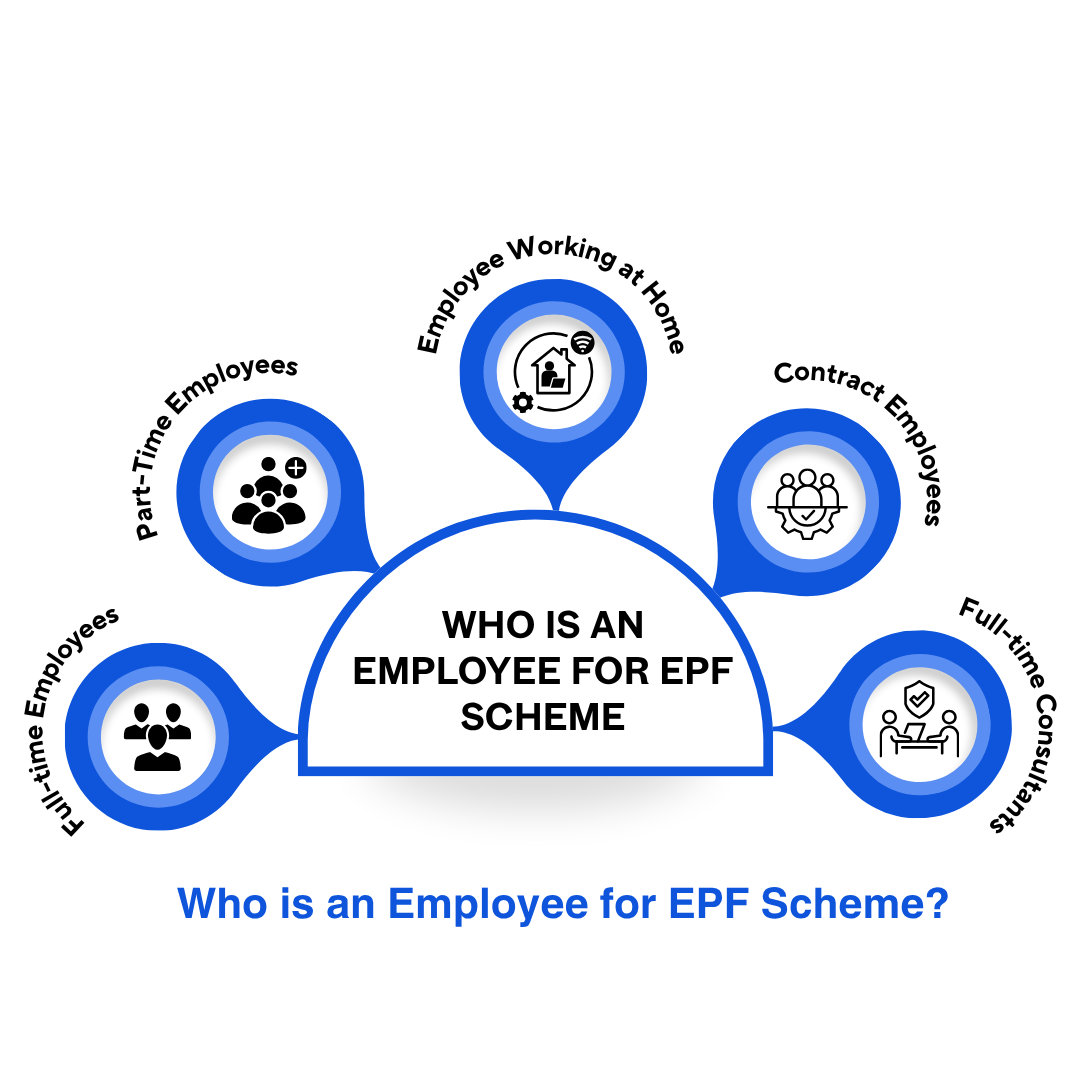

EPF Registration is mandatory for all those organizations that have 20 or more employees. Such organizations are required to contribute a fixed amount towards Provident Fund out of employee salary. The fixed amount that the employer is required to make is 12% of the Basic Salary plus DA and RA.

Employees Provident Fund is a government-based scheme under the Employee Provident Funds and Miscellaneous Provisions Act, 1952. It acts as a retirement benefit to an employee which is provided the organization. Any company having more than twenty employee working is mandatory required to obtain EPF Registration under EPF Act.The objective behind the EPF Scheme is to mainly maintain a healthy relationship between the employer and employee. Employee-Employer bond.

Need assistance? Don't worry, experts are here to help!

Call us at: 011 4050 3140 or Email us: info@topfilings.com

Empower your business with in-depth articles, frequently asked questions, and expert guides covering GST, compliance, and startup essentials.